Real estate investing offers significant opportunities for wealth creation, but it’s not without risks.

From market fluctuations to property-specific issues, savvy investors must adopt strategies to minimize risks and ensure long-term profitability.

By diversifying your real estate portfolio and leveraging key risk mitigation techniques, you can create a safer and more resilient investment portfolio.

In this guide, we’ll explore practical tips for mitigating risks in real estate investments, focusing on diversification through location, property types, and market analysis.

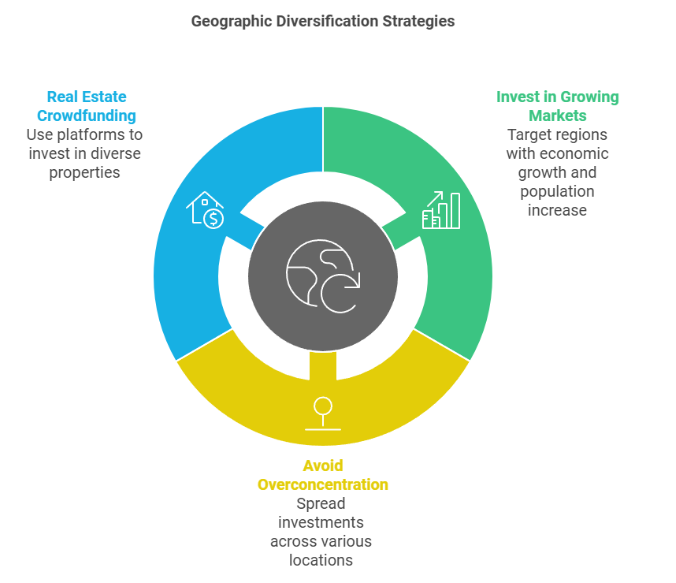

1. Diversify Across Locations

Investing in a single geographic area can expose you to market-specific risks, such as economic downturns, regulatory changes, or natural disasters.

Geographic diversification allows you to spread risk across different regions, ensuring that your portfolio isn’t overly dependent on one market’s performance.

How to Diversify by Location

- Invest in Growing Markets: Research regions with strong economic growth, job opportunities, and population increases. Tools like the U.S. Census Bureau’s data can help identify such markets.

- Avoid Overconcentration: Spread your investments across cities, states, or even countries to reduce localized risks.

- Consider Real Estate Crowdfunding Platforms: Platforms like Fundrise or CrowdStreet allow you to invest in properties across multiple regions with lower capital requirements.

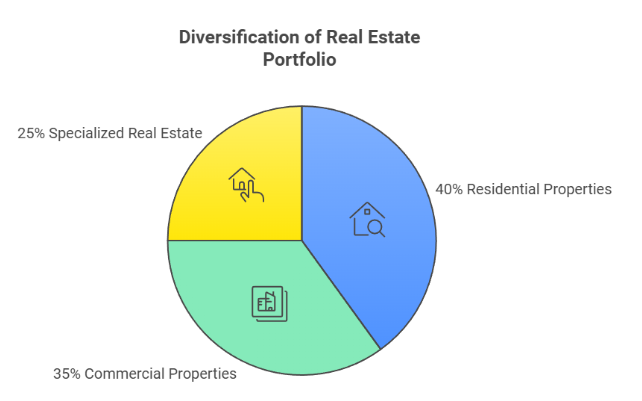

2. Choose a Mix of Property Types

Focusing on a single property type, such as residential or commercial, can leave your portfolio vulnerable to sector-specific risks.

Diversifying across property types provides balance and can shield your portfolio from downturns in one segment.

Property Types to Consider

- Residential Properties: Single-family homes, multi-family buildings, or rental apartments. These are generally less volatile and offer consistent cash flow.

- Commercial Properties: Office buildings, retail spaces, and warehouses. These can provide higher returns but may be riskier during economic downturns.

- Specialized Real Estate: Student housing, senior living facilities, or vacation rentals. These niches often have unique demand drivers that can enhance portfolio resilience.

Pro Tip:

Use tools like CoStar or Zillow Rental Manager to analyze property performance metrics and identify the best opportunities for diversification.

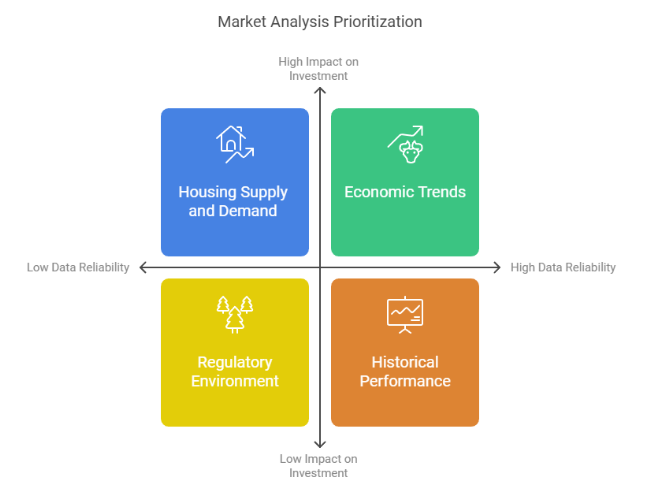

3. Conduct Thorough Market Analysis

Market analysis is critical for making informed investment decisions and avoiding pitfalls. A poorly analyzed market can lead to vacancy issues, overpaying, or failing to predict downturns.

Key Factors to Evaluate

- Economic Trends: Focus on job growth, unemployment rates, and income levels. Resources like the Bureau of Labor Statistics (BLS) provide reliable data.

- Housing Supply and Demand: High demand with limited supply often signals strong investment potential.

- Regulatory Environment: Understand local zoning laws, tax policies, and rent control regulations.

- Historical Performance: Review past property value trends using platforms like Redfin or Realtor.com.

4. Incorporate Risk-Reducing Strategies

To further mitigate risk, investors should adopt specific strategies that protect their portfolios from unexpected challenges:

1. Buy Below Market Value

Purchasing properties below their market value provides a cushion against price drops. Use platforms like Auction.com or network with distressed property sellers to find undervalued deals.

2. Secure Adequate Insurance

Ensure you have comprehensive coverage, including hazard, liability, and flood insurance, to protect against property-specific risks.

3. Use Long-Term Fixed-Rate Financing

Fixed-rate loans shield you from rising interest rates, ensuring predictable financing costs.

4. Build a Contingency Fund

Set aside reserves for unexpected repairs, vacancies, or market downturns. Aim for at least 3-6 months of expenses per property.

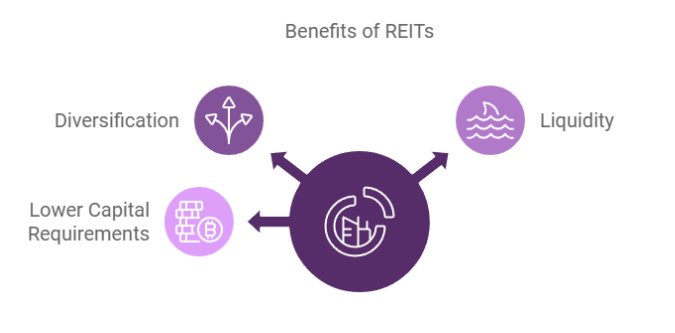

5. Leverage Real Estate Investment Trusts (REITs)

If direct property ownership feels too risky or resource-intensive, consider investing in Real Estate Investment Trusts (REITs). These funds pool money to invest in a diversified portfolio of properties, offering exposure to real estate without the responsibilities of ownership.

Benefits of REITs

- Diversification: Gain access to multiple properties across various sectors.

- Liquidity: Unlike physical real estate, REITs are traded on stock exchanges, allowing you to buy and sell shares easily.

- Lower Capital Requirements: Start investing with smaller amounts compared to purchasing properties outright.

Check platforms like Public.com or Schwab REIT ETFs to explore REIT options.

6. Monitor and Adjust Your Portfolio

Real estate markets are dynamic, and a well-performing property today may underperform tomorrow. Regularly reviewing your portfolio ensures it remains aligned with your investment goals.

Actionable Steps

- Track Market Conditions: Use tools like CoreLogic to monitor market trends and adjust strategies accordingly.

- Rebalance Your Portfolio: If one property type or location becomes overrepresented, consider shifting funds to balance your portfolio.

- Stay Updated on Regulations: Local and federal regulations can change, impacting your investments. Resources like Nolo’s Real Estate Law Center provide updates on legal changes.

Building a Safer Real Estate Portfolio

Mitigating risk in real estate investing requires careful planning, thorough research, and ongoing portfolio management.

By diversifying across locations and property types, conducting detailed market analysis, and adopting proven risk-reduction strategies, you can create a more stable and resilient portfolio.

Ready to Expand Your Real Estate Portfolio?

Consider leveraging a First Lien HELOC to unlock home equity and fund new investments.

Try our First Lien HELOC calculator today to discover how much equity you can access to grow your wealth.