The internet's #1 platform for helping American homeowners

pay off their mortgage using a 1st Lien HELOC

A revolutionary new home financing option where you can save thousands on interest, simplify your financial life, and pay off your home in as little as 5-7 years.*

Find us on your favorite social channels.

Unlock financial freedom with a 1st Lien HELOC

New here?

Welcome to the 1st Lien HELOC Community!

Firstlienheloc.com’s #1 goal is to help our community rapidly pay off their mortgage using cutting edge ideas and financial strategies. We are dedicated to educating you on how to use these strategies – for free! Please read through our guides and walk throughs to get a feel for the financial strategies, and then head on over to our calculator to try this out for yourself.

Smiles and Stories: Hear From Our Happy Customers – Watch Their Heartwarming Testimonials!

When shopping homes, we’ve all been trained to focus on interest rate first, and everything else last. But what happens when you shift your paradigm? These homeowners took our strategies and recommendations and made it work for them… see their amazing results & journey.

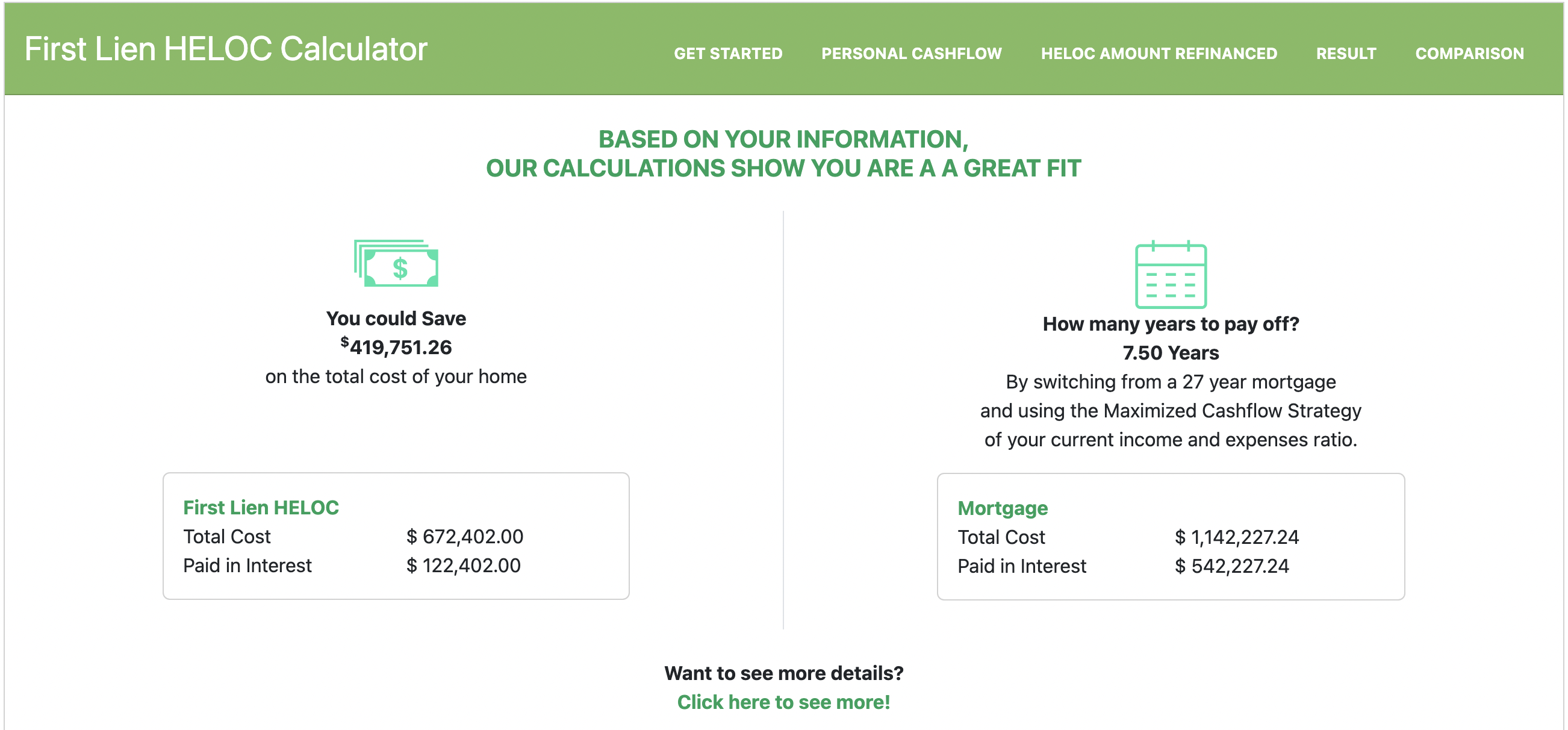

Wondering if this works for you?

Try the 1st Lien HELOC calculator

Skip the waiting line and see if these strategies could help you chop your mortgage in half. That’s right, we custom built the internet’s #1 First Lien HELOC calculator (and no… it wasn’t easy!). We see so many homeowners use this tool as a first step in their financial growth journey, see for yourself if you have the financial circumstances to take advantage of a First Lien HELOC and change your life forever.

remember...

Interest rate is only 1 variable

that factors into how much you actually pay for your home.

Real Estate's Best Kept Secret

There's a smarter way to pay off your mortgage.

Heard of Velocity Banking? It’s okay – many still haven’t. Velocity Banking is a financial strategy using your personal monthly (your total income – your expenses = cashflow) and a HELOC to rapidly pay down your principal balance on your debts (primarily your mortgage). This simple technique hacks the way that interest accumulates (over time) so that you end up cutting 5 or 6 figures off your total interest payment on your loan.*

Introducing the First Lien HELOC

What is it?

A First Lien HELOC is a type of mortgage loan that is secured against the equity in your home. Generally set to 10 year terms, this loan product allows you to make payments toward the balance, or withdraw money from your equity. The RIGHT First Lien HELOC will come with an integrated sweep account, which applies any “checking account balance” directly to your loan balance each day. Most importantly, this loan calculates the interest using the average daily principal balance instead of how an amortized loan does.

Why does interest calculation matter?

Banks use different ways to calculate interest across different loan and credit products. Turns out, the fact that the bank uses a different calculation for a HELOC’s interest payment, and a mortgage interest payment means that there’s an opportunity to exploit these differences and save big.. HELOCs use an interest calculation based on the previous month’s Average Daily Balance. If you do some math, you realize that if you pay down your principal faster than a typical amortization schedule, you end up saving an enormous amount of interest.

That itself isn’t revolutionary. But what is revolutionary is when you combine this principal with flexibility of a HELOC, you can maximize your cashflow without losing a safety reserve to minimize your interest liability. We call this the Velocity Banking.

Side by side comparison

Loan Type

Mortgage

First Lien HELOC

Home Price

$ 360,000.00

$ 360,000.00

Interest Rate

8%

7.375%

Total Interest Paid

$ 290,147.38

$ 71,539.00

Time to Payoff

20 years

6.42 years

Please note that the monthly income and expenses needed to afford these payments would depend on various other factors, including the borrower’s other debts, living expenses, and financial goals.

Please also keep in mind that this does not account for any other financial considerations such as varying interest rates over time, potential changes in income, or any additional financial obligations. It also assumes that all of the remaining income after the loan payment is available for other expenses, which may not be accurate after taxes and other deductions. These are mere simplified estimates that assume the rest of the person’s income is available for other expenses and do not account for taxes or other deductions that would reduce net take-home pay. Actual required income could be higher depending on tax rates and other financial obligations.

Home Price

Mortgage - $ 360,000.00

FLH - $ 360,000.00

Interest Rate

Mortgage - 8%

FLH - 7.375%

Total Interest Paid

Mortgage - $ 290,147.38

FLH - $ 71,539.00

Time to Payoff

Mortgage - 20 years

FLH - 6.42 years

Please note that the monthly income and expenses needed to afford these payments would depend on various other factors, including the borrower’s other debts, living expenses, and financial goals.

Please also keep in mind that this does not account for any other financial considerations such as varying interest rates over time, potential changes in income, or any additional financial obligations. It also assumes that all of the remaining income after the loan payment is available for other expenses, which may not be accurate after taxes and other deductions. These are mere simplified estimates that assume the rest of the person’s income is available for other expenses and do not account for taxes or other deductions that would reduce net take-home pay. Actual required income could be higher depending on tax rates and other financial obligations.

Velocity Banking & First Lien HELOC Combination

Your Home Loan Needs the Following Features

When it comes to harnessing your home’s equity to achieve financial goals, the First Lien HELOC (Home Equity Line of Credit) stands out as a dynamic tool.

Let’s delve into its key features, understanding how they empower you to take charge of your financial journey.

Integrated Checking Account with BI-DIRECTIONAL SWEEP

Having an Integrated Checking Account with a Bi-Directional Sweep attached to your First Lien HELOC may be one of the most important features to look for when shopping for a First Lien HELOC.

When implementing Velocity Banking, money somehow has to be transferred between a checking account and the First Lien HELOC for every single transaction for the month.

When that responsibility is put on the borrower, the upkeep of this is often much more trouble than what people initially expect, which can lead to frustration, mistakes, and additional costs.

As it turns out, this burden when put on the borrower, is the main reason why people quit the strategy, or fail altogether.

Having an Integrated Checking Account with a Bi-Directional Sweep automates these transfers for you, so the task of transferring between the two vehicles is 100% efficient because it’s automated and managed by the bank.

All in all, an Integrated Checking Account with a Bi-Directional Sweep ensures that you don’t have to keep up with manually transferring funds for the remainder of the loan.

Debit Cards, Checks & Online Bill Pay

Easily paying for the expenses you incur during the month is extremely important, and the fewer changes to your lifestyle that happen, the higher likelihood you’ll have to succeed with the strategy.

Most regular checking accounts include Debit Cards, Checks, and online Bill Pay capabilities, so in order to ensure that your lifestyle is consistent after getting a First Lien HELOC, you’ll want to look for one with options that include these as well.

Automatic Payments

One of the benefits of a First Lien HELOC, is that the available equity can be used to pay for the interest payment each month. When this payment is not automated, you have to transfer money from the HELOC into a checking account, and then pay the bank the interest payment due.

Without an automated payment it adds two additional steps to your plate each month, and opens the door for a late payment in the case that you forget one month.

Be sure to look for a First Lien HELOC that offers automatic payments that automatically takes a draw from the HELOC’s available line to pay the interest payment to avoid the hassle of doing it yourself, and to guarantee that you’ll never have a late payment as long as you’ve got enough equity to cover the payment.

Efficient Interest Calculation

The way interest is calculated with a First Lien HELOC is advantageous. It’s computed based on the previous month’s average daily balance, and uses this average daily balance along with the interest rate, to calculate your interest payment.

This means that any reduction in your balance directly impacts your interest costs. With smart financial management, you can minimize interest payments and accelerate your path to financial freedom.

Interest-only Payment Option

During the draw period of a First Lien HELOC, you often have the option to make interest-only payments. This can be advantageous for short-term needs or investment opportunities, allowing you to manage your cash flow more efficiently. Some HELOCs mandate a principal & interest payment, be sure to choose a HELOC that only requires an interest-only payment.

Bank-Held and Bank-Serviced Loan

Remember, many mortgage companies, once they get a loan, sell it to another company pretty quickly. If this happens with a First Lien HELOC, the Mortgage Loan Officer who helps you get the HELOC wouldn’t work with or necessarily know anyone on the team that ends up servicing your loan.

This can make it tough to get issues resolved once you have your First Lien HELOC if the Loan Officer doesn’t know who you should talk with or can’t provide a solution.

Finding a bank that keeps and services their loans in-house ensures that the Loan Officer will know the team that provides support after you have the HELOC and can direct you to them if there’s any issue.

Additionally, the bank team can notify the Loan Officer in case you come to them with strategy questions that they’re unable to answer.

A team of people who specialize in First Lien HELOCs

Although this isn’t necessarily a “feature” of a First Lien HELOC, it’s definitely something you’ll want to look for during your search. Many bankers and Loan Officers do offer a First Lien HELOC, however many have no they do, and even fewer know how to help you use it to improve your financial situation.

Without proper guidance, a First Lien HELOC can be a financial vehicle that provides no benefit at all, and has the potential to be financially damaging to a household if not utilized correctly.

Working with a team that specializes in both the First Lien HELOC product and the Maximized Cashflow Strategy (Velocity Banking) will ensure that you are getting the best advice for your particular situation from an expert who understands the strategy and is aware of the pitfalls.

By doing so, you can fully discern whether it’s a good fit for you, you can learn how to best the loan for your particular goals, you can create long-standing relationships with experts for future questions, and you can avoid common mistakes, all setting you up for success in the future!

First Lien HELOC

- Sweep Functionality

- Overdraft Protection

- Debit Card

- Online Bill Pay

- Checking Account

- Deposits & Withdrawals

Ready to apply?

Consult a

First Lien HELOC Lender

We’ve partnered with several banks to help you find the right loan product. It’s important to understand, this is still a pretty niche loan offering, and most banks don’t offer the right features needed to make the loan and velocity banking strategy work.

When you go through our sign up system, we’ll take in a bit of information about you and match you to a qualified lender who can help you take the next steps, and consult with you along the way.

Sign up online

Get started by signing up with FirstLienHeloc.com. By simply navigating to our sign up form on this page.

We connect you with the right bank

After signing up, we’ll confirm your new membership with our site, and we’ll connect you to the right qualified lender so that you can weigh you options and make an informed decision.

Apply for your 1st Lien HELOC

After weighing your options, you’ll want to go ahead and submit an official loan application with your designated bank. A loan officer will be able to help you through the specifics steps here, as each bank might have different qualifications you must pass.

Consultation

After submitting your application, a loan officer will review your application and reach out to you to schedule a time to discuss your First Lien HELOC use cases and qualifications.

Closing

After working with your qualified lender, your Loan Officer will reach out to you to schedule your closing date on your First Lien HELOC.

Newest Ambassadors & Community Contributors

Join the movement that is revolutionizing home finance.

Learn more about our Ambassador Program and become a community contributor today!