Mortgage vs. 1st Lien HELOC: What’s the Difference?

Updated as of January 2, 2024 | FirstLienHELOC.com

Industry HeavyWeight: The Traditional Mortgage

A traditional mortgage loan is when you borrow money to purchase or refinance your home. Typically, this is a fixed interest rate though adjustable rate mortgages are out there as well. The term of the loan can be anywhere from 10 to 40 years.

Mortgages have been an established option for most consumers when it comes to buying a home, and for good reason. But there are several key differences between a Mortgage and a 1st lien HELOC that can show just how lack luster a traditional mortgage can be.

With a traditional mortgage, a small fraction you every payment you make reduces the amount that you owe on the loan. The only way that the loan amount would increase is if you refinance and take out your equity in cash or a “cash-out refi” as it is commonly called.

Another type of home loan is a home equity line of credit or a First Lien HELOC. This type of loan is known as an “open ended loan”. While this loan has a maximum amount you can use at one time, the amount you owe can fluctuate over time. You can make payments to reduce the line and also borrow more money at any time.

The payments on a First Lien HELOC are not fixed because they fluctuate depending on the current balance. The payment in this type of loan is “interest only”, which allows you to maximize any principal reduction by any extra above the interest owed you may apply throughout the month.

In addition to the fixed payment versus the varying balance and interest only payment, another HUGE difference is in the interest charged and the way it is calculated. Let’s take an in-depth look at the interest calculations between the two.

Interest Calculation on a Traditional Mortgage

By design, a traditional mortgage loan always earns interest first. This type of loan is called an amortized loan. By definition, an amortized loan payment first pays any and all interest expense that has accrued for that payment period. Any remaining amount of the payment is then put towards reducing the principal balance. If you pay your property taxes and home owner’s insurance “in escrow”, these amounts are in addition to any principal and interest payment. When you sign your loan papers, the entire amount owed is calculated in advance and then divided into fixed monthly payments. However the amount of the payment itself is then divided between principal and interest.

Mortgage:

- At the beginning of your loan, most of your monthly payment will go towards interest, not the principal. That is because the amount of interest recalculates each month and you must always pay the interest first.

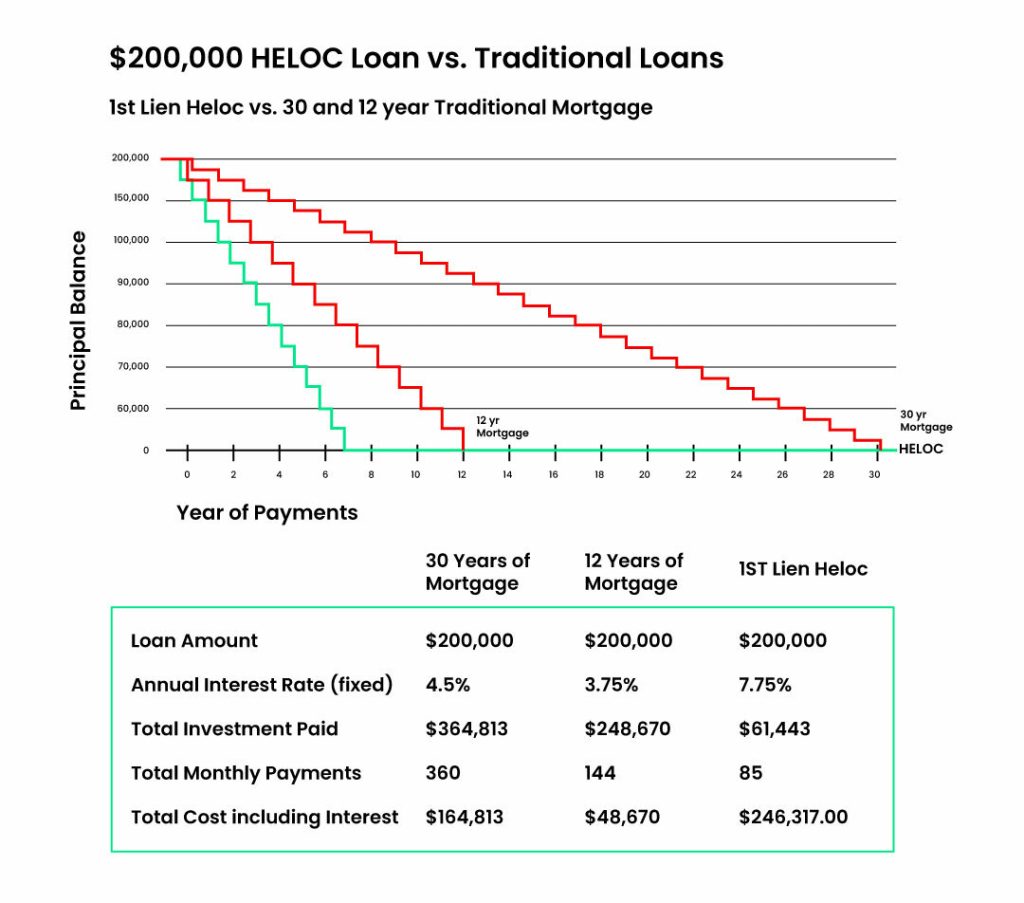

- Let’s say you have a loan for $200,000 at 4.5% interest for 30 years. Your monthly principal and interest payment (excluding escrows) would be $1013.00. For your first 36 months (3 years) you will pay $26,350 in interest and only $10,130 in principal.

- As you can see, you will pay far more in interest than in principal, as this calculation was only for the first 36 months. You can expect that more of your payment will go towards interest than principal for approximately the first 12 years of a 30-year mortgage. Your total interest paid for the life of this loan, if you pay it off in 30 years is $164,813.

1st Lien HELOC

- Now let’s look at using a First Lien HELOC and the strategy used to reduce your interest cost. Using our previous example of a $200,000 loan at the same interest rate with a monthly income of $6,250 and other monthly expenses of $3,000, in 36 months you will only have paid $20,811 in interest BUT you will also have paid $96,189 towards your principal balance!

- Keeping this same scenario and continuing to use the First Line HELOC strategy, you will pay your $200,000 loan off in 5 years and 9 months. Your total interest paid for the life of the loan is only $27,710.

First Lien HELOC vs. A Traditional Mortgage

Depending on your situation, First Lien HELOCs could also be a better alternative to a second mortgage. Second Mortgage interest rates tend to run higher than HELOCs. Getting a second mortgage compounds these interest rates so they can run even higher than your first mortgage.

HELOCs and mortgages are largely different home loan options because they don’t offer similar spending flexibility or availability of funds.

Achieve Financial Freedom

Sign up on FirstLienHeloc.com to get connected with a licensed lender who can deliver an all-in-one 1st Lien HELOC. They’ll walk you through the application process and help outline your budget, your numbers, and exactly how much you can save by replacing your mortgage.