Peer-to-peer (P2P) lending has transformed the way people borrow and invest, offering a unique alternative to traditional financial systems.

By connecting borrowers directly with investors, P2P lending platforms allow individuals to earn passive income through interest payments while supporting borrowers who may lack access to conventional loans.

In this guide, we’ll explore how P2P lending works, its benefits and risks, and how investors can leverage platforms like Prosper and LendingClub to diversify their portfolios and generate consistent returns.

What Is Peer-to-Peer Lending?

P2P lending is a form of direct lending where investors provide funds to borrowers through online platforms.

These platforms act as intermediaries, facilitating the transaction, assessing borrower risk, and managing repayments.

Unlike traditional lending through banks, P2P lending offers higher returns for investors and lower interest rates for borrowers.

How It Works:

- Borrowers Apply for Loans: Borrowers submit loan applications, including the purpose (e.g., debt consolidation, home improvement) and desired loan amount.

- Risk Assessment: The platform evaluates the borrower’s creditworthiness and assigns a risk grade that determines the interest rate.

- Investors Fund the Loans: Investors browse available loans and allocate funds to those that match their risk and return preferences.

- Repayment: Borrowers make monthly payments, including principal and interest, which are distributed to investors.

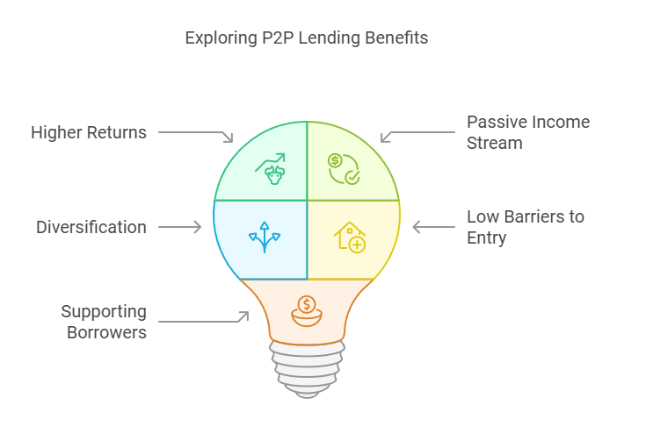

Benefits of P2P Lending for Investors

P2P lending offers unique advantages that make it an appealing option for investors seeking passive income and diversification:

1. Higher Returns

- P2P lending often yields higher interest rates compared to traditional savings accounts, bonds, or CDs.

- Example: Platforms like Prosper report average annual returns between 5% and 8%, depending on the risk level of the loans.

2. Passive Income Stream

- Investors receive monthly repayments of principal and interest, creating a steady stream of income.

3. Diversification

- P2P lending allows you to diversify within the asset class by funding multiple loans across different risk grades, industries, and loan purposes.

4. Low Barriers to Entry

- Unlike real estate or other high-capital investments, P2P lending platforms typically have low minimum investment requirements.

- Example: Prosper allows investors to start with as little as $25 per loan.

5. Supporting Borrowers

- By participating in P2P lending, investors can support individuals or small businesses that may not qualify for traditional loans, adding a personal, impactful element to their investments.

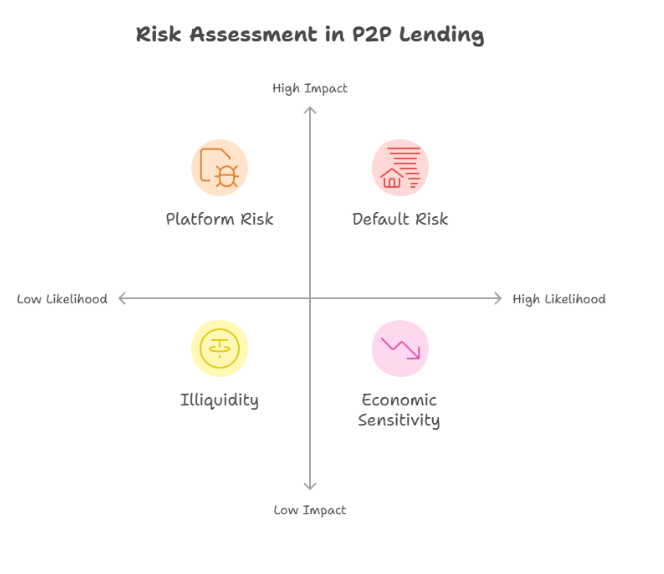

Risks of P2P Lending

While P2P lending offers attractive returns, it also comes with risks that investors must carefully manage:

1. Default Risk

- Borrowers may default on their loans, resulting in a loss of principal and interest for investors. The risk increases with lower credit grades.

2. Illiquidity

- Once funds are allocated to loans, they cannot be easily withdrawn or sold before maturity, making P2P lending less liquid than stocks or ETFs.

3. Platform Risk

- The success of your investment relies on the platform’s stability. If a platform goes out of business, it could disrupt loan repayments or access to funds.

4. Economic Sensitivity

- P2P lending is sensitive to economic downturns, which can increase default rates as borrowers struggle to repay loans.

5. Limited Regulatory Protections

- P2P lending is less regulated than traditional banking, meaning there are fewer safeguards in case of disputes or losses.

How to Get Started with P2P Lending

If you’re ready to explore P2P lending, follow these steps to get started:

1. Choose a Reputable Platform

Research platforms that align with your investment goals. Popular P2P lending platforms include:

- Prosper: A well-established platform offering personal loans with a focus on transparency and borrower risk grading.

- LendingClub: The largest P2P lending platform in the U.S., known for its diverse loan offerings and robust risk assessment tools.

- Upstart: Uses AI-driven models to assess borrowers, potentially offering access to higher-risk, higher-reward loans.

2. Set an Investment Budget

Determine how much you’re willing to invest. Start with a small portion of your portfolio (e.g., 5-10%) to manage risk while testing the waters.

Click here to learn more about setting an investment budget

3. Diversify Across Loans

Reduce default risk by spreading your investment across multiple loans with varying risk grades. For example:

- Invest $25-$100 per loan to fund 10-50 loans instead of allocating all your funds to a single borrower.

4. Assess Risk Grades

Platforms assign risk grades to loans based on borrower creditworthiness. Higher-risk loans offer higher potential returns but come with a greater chance of default. Balance your portfolio with a mix of:

- A/B Grades: Lower risk, lower returns.

- C/D Grades: Moderate risk, moderate returns.

- E/F Grades: High risk, high returns.

5. Automate Your Strategy

Many platforms offer automated investment tools that allow you to set criteria for risk grades, loan terms, and industries.

This ensures consistency and saves time.

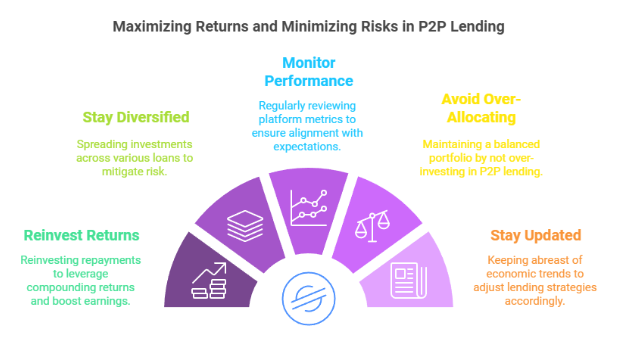

Strategies for Success in P2P Lending

To maximize returns and minimize risks, consider these proven strategies:

1. Reinvest Returns

Reinvesting monthly repayments into new loans allows you to benefit from compounding returns. Over time, this strategy can significantly boost your earnings.

2. Stay Diversified

Spread your investment across different loans, borrowers, and risk grades. Aim for at least 50-100 loans to mitigate the impact of individual defaults.

Read this blog to learn how you can manage your finances better for investments

3. Monitor Platform Performance

Regularly review platform metrics, such as default rates and average returns, to ensure the platform aligns with your expectations.

4. Avoid Over-Allocating

While P2P lending offers high returns, it should not represent a disproportionate share of your portfolio. Balance it with traditional investments like stocks, bonds, and ETFs.

5. Stay Updated on Economic Trends

P2P lending is sensitive to economic cycles. During recessions, consider focusing on borrowers with higher credit grades to reduce default risk.

NBC News is a great platform to be updated on the latest news on the economy.

Who Should Consider P2P Lending?

P2P lending is ideal for:

- Income-Focused Investors: Those seeking passive income through monthly repayments.

- Diversified Portfolios: Investors looking to add an alternative asset class to balance traditional stocks and bonds.

- Hands-On Investors: Individuals who enjoy selecting loans and actively managing their portfolios.

Is P2P Lending Right for You?

P2P lending offers an innovative way to earn passive income while supporting borrowers. By carefully selecting platforms, diversifying investments, and managing risk, you can unlock the potential for attractive returns in this emerging asset class.

Ready to Start Earning Passive Income?

Consider leveraging a First Lien HELOC to fund your P2P investments.

Unlock your home equity with our First Lien HELOC calculator and begin building your passive income strategy today!