Crowdfunding has revolutionized the way startups and businesses raise capital, offering investors a chance to support early-stage ventures and access opportunities once reserved for venture capitalists and angel investors.

From technology startups to real estate projects, crowdfunding allows individuals to diversify their portfolios and potentially earn significant returns.

However, investing in crowdfunding campaigns comes with unique risks and challenges.

In this guide, we’ll explore the risks, rewards, and strategies for success that every investor should know to make informed decisions in this exciting and evolving investment space.

What Is Crowdfunding for Investors?

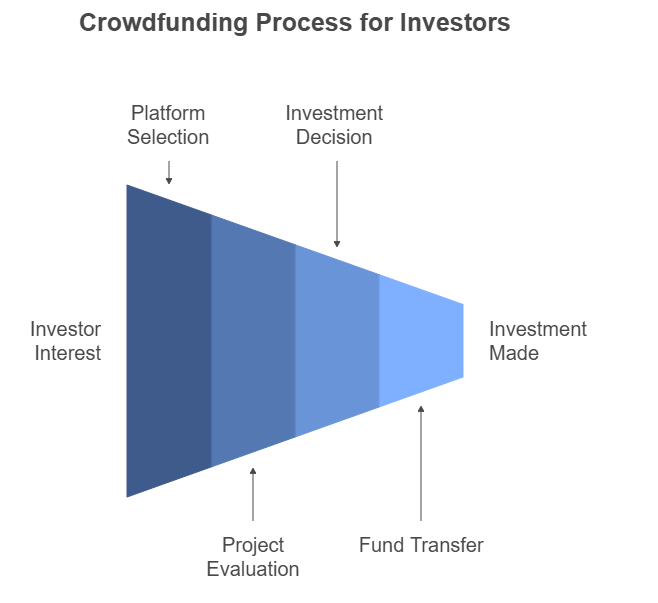

Crowdfunding is a method of raising capital from a large number of individuals, often through online platforms.

For investors, it provides access to early-stage investment opportunities that might otherwise be unavailable. There are several types of crowdfunding models, each offering different investment opportunities:

1. Equity Crowdfunding

Investors provide capital in exchange for equity or shares in a company. This means you become a partial owner and may profit from dividends or future exits, such as acquisitions or IPOs.

- Examples: Startups on platforms like SeedInvest, WeFunder, or Republic.

2. Debt Crowdfunding (Peer-to-Peer Lending)

Investors lend money to businesses or individuals and earn interest over time. These loans typically come with fixed terms and repayment schedules.

- Examples: Platforms like Funding Circle or LendingClub.

3. Reward-Based Crowdfunding

Investors contribute to campaigns in exchange for non-monetary rewards, such as products or services. This is common for creative projects.

- Examples: Platforms like Kickstarter or Indiegogo.

4. Real Estate Crowdfunding

Investors pool money to fund real estate projects, earning returns through rental income, appreciation, or interest payments.

- Examples: Platforms like Fundrise, RealtyMogul, or CrowdStreet.

Rewards of Crowdfunding for Investors

Crowdfunding offers unique benefits that appeal to both novice and seasoned investors. Here’s why it’s an attractive option:

1. Access to Early-Stage Companies

Crowdfunding platforms provide a gateway to invest in startups and businesses at an early stage, allowing you to get in on the ground floor of potentially high-growth ventures.

2. Portfolio Diversification

By investing small amounts across multiple campaigns, investors can diversify their portfolios, reducing risk while exploring new sectors or asset classes.

3. High Return Potential

Successful crowdfunding investments can deliver substantial returns. For example, early investors in companies like Oculus Rift (acquired by Facebook) saw significant profits.

4. Supporting Innovation

Crowdfunding gives investors the opportunity to support innovative ideas and entrepreneurs, creating a sense of personal satisfaction alongside financial gain.

5. Low Entry Barrier

Unlike traditional venture capital, crowdfunding often allows participation with small investments, making it accessible to a wider range of investors.

Risks of Crowdfunding Investments

While the potential rewards are enticing, investors must be aware of the risks involved:

1. High Failure Rate

Many startups fail, and there’s no guarantee of returns. Equity crowdfunding, in particular, carries a high risk of total loss if the business doesn’t succeed.

2. Illiquidity

Crowdfunding investments are often illiquid, meaning you may not be able to sell your stake or access your funds until there’s an exit event, such as a company sale or IPO.

3. Limited Regulation

While platforms are regulated, the businesses listed on them may not have the same level of scrutiny as publicly traded companies, increasing the risk of fraud or mismanagement.

4. Valuation Challenges

Startups may have inflated valuations, making it difficult for investors to assess whether they’re paying a fair price for equity.

5. Lack of Dividends

Unlike traditional stocks, most startups reinvest profits for growth rather than paying dividends, so your returns may only come from a successful exit.

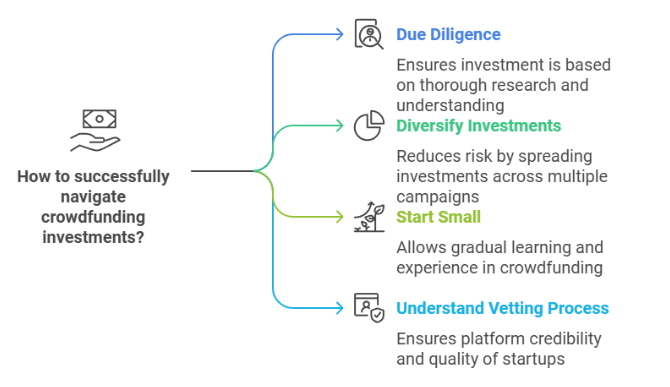

Strategies for Successful Crowdfunding Investments

To navigate the risks and increase your chances of success, follow these strategies:

1. Do Thorough Due Diligence

Research the company, its founders, and its market potential. Look for the following:

- Business Model: Is it scalable and sustainable?

- Market Opportunity: Does the startup address a clear need or gap in the market?

- Founders’ Experience: Do the founders have relevant expertise or a track record of success?

2. Diversify Your Investments

Spread your investments across multiple campaigns to reduce risk. For example, instead of investing $10,000 in one startup, consider investing $1,000 in 10 different companies.

3. Start Small

Begin with smaller investments to gain experience and understand the crowdfunding process. As you become more comfortable, you can increase your investment amounts.

4. Understand the Platform’s Vetting Process

Not all crowdfunding platforms are created equal. Choose platforms with rigorous vetting processes to ensure the businesses listed have been carefully evaluated.

5. Evaluate the Exit Strategy

Understand how and when you might see a return on your investment. Does the startup have a clear exit plan, such as an acquisition or IPO?

6. Stay Updated

Crowdfunding investments require ongoing monitoring. Stay informed about the company’s progress and any updates from the platform.

7. Consult a Financial Advisor

If you’re new to crowdfunding or considering significant investments, consult a financial advisor to assess how these investments fit into your broader portfolio.

Top Crowdfunding Platforms for Investors

Here are some reputable platforms where investors can explore crowdfunding opportunities:

1. Equity Crowdfunding

- SeedInvest: Offers highly vetted startups with significant growth potential.

- WeFunder: Provides access to a diverse range of early-stage companies.

- Republic: Known for inclusive investing with low minimums.

2. Debt Crowdfunding

- LendingClub: Focused on personal and small business loans.

- Funding Circle: Specializes in loans for small businesses.

3. Real Estate Crowdfunding

- Fundrise: Ideal for beginners interested in real estate portfolios.

- CrowdStreet: Focuses on large-scale commercial real estate projects.

4. Reward-Based Crowdfunding

- Kickstarter: Perfect for creative projects and innovative products.

- Indiegogo: Supports a wide variety of campaigns, from tech to community initiatives.

Crowdfunding Success Stories

To inspire confidence, here are a few notable crowdfunding success stories:

- Oculus Rift: Raised $2.4 million on Kickstarter before being acquired by Facebook for $2 billion.

- Allbirds: Launched on Kickstarter and is now a globally recognized sustainable footwear brand.

- Exploding Kittens: Raised $8.7 million on Kickstarter to become one of the best-selling card games.

Crowdfunding Right for You?

Crowdfunding offers investors an exciting opportunity to access early-stage businesses and diversify their portfolios.

While the risks are significant, careful research, diversification, and strategic investing can help you maximize your chances of success.

Looking to Fund Your Crowdfunding Investments?

Consider leveraging a First Lien HELOC to unlock the equity in your home and invest in promising startups.

Try our First Lien HELOC calculator today to see how much capital you can access to pursue your investment goals.