Uncertainty is a constant in life, and whether it stems from economic downturns, unexpected medical expenses, or job loss, having a financial safety net can provide invaluable security.

Building this safety net is about more than just saving money—it’s about creating a well-rounded plan that includes emergency funds, insurance, and low-risk investments to weather life’s challenges.

In this guide, we’ll explore the key components of a financial safety net and provide actionable steps to help you safeguard your financial future.

Why You Need a Financial Safety Net

Personal finance experts like Dave Ramsey and Suze Orman emphasize the importance of financial resilience during uncertain times.

Without a safety net, unexpected expenses or income disruptions can lead to high-interest debt, stress, and long-term financial instability.

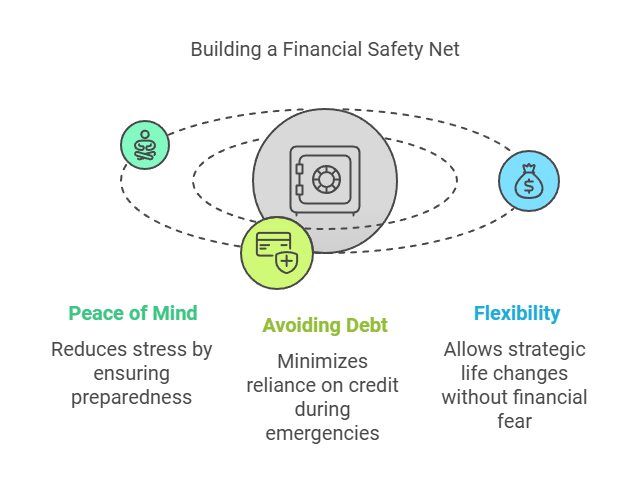

Key Benefits of a Financial Safety Net:

- Peace of Mind: Knowing you’re prepared for the unexpected can alleviate financial stress and allow you to focus on long-term goals.

- Avoiding Debt: A safety net reduces reliance on credit cards or loans during emergencies.

- Flexibility: It gives you the freedom to make strategic life or career changes without fear of financial ruin.

1. Build an Emergency Fund

An emergency fund is the cornerstone of any financial safety net.

It serves as a cash reserve specifically designated for unforeseen expenses, such as medical bills, car repairs, or temporary income loss.

How Much Should You Save?

- Beginner Goal: Start with $1,000 for immediate emergencies.

- Long-Term Goal: Aim for 3-6 months of essential living expenses. For example, if your monthly expenses total $3,000, your fund should range between $9,000 and $18,000.

Where to Keep Your Emergency Fund

Store your emergency fund in a high-yield savings account or money market account for easy access and low risk. Popular options include:

Tips for Building Your Emergency Fund:

- Automate Savings: Set up automatic transfers from your checking account to your emergency fund.

- Cut Non-Essential Spending: Reduce dining out, streaming subscriptions, or other discretionary expenses temporarily.

- Use Windfalls Wisely: Direct tax refunds, bonuses, or monetary gifts into your emergency fund.

2. Invest in Insurance

Insurance is a critical layer of protection that shields you from catastrophic financial losses.

Each type of insurance addresses specific risks, and having the right coverage is essential for building a robust safety net.

Key Types of Insurance:

- Health Insurance:

- Covers medical expenses and protects against exorbitant healthcare costs.

- Consider supplemental plans for dental, vision, or critical illness if not covered by your primary policy.

- Life Insurance:

- Provides financial support for your family in the event of your death. Term life insurance is often recommended for its affordability and straightforward coverage.

- Expert Insight: Suze Orman advocates for term life insurance over whole life insurance for most people, as it provides ample coverage at a lower cost.

- Disability Insurance:

- Replaces a portion of your income if you’re unable to work due to illness or injury. Long-term disability insurance is particularly important for breadwinners.

- Homeowners or Renters Insurance:

- Protects your home or belongings against theft, natural disasters, and accidents.

- Auto Insurance:

- Provides coverage for accidents, theft, or damage to your vehicle.

- Umbrella Insurance:

- Offers additional liability coverage that kicks in when your primary policies’ limits are exceeded. It’s especially valuable for high-net-worth individuals.

Action Steps:

- Assess Your Needs: Evaluate your lifestyle, assets, and dependents to determine your insurance requirements.

- Shop Around: Use comparison tools like Policygenius to find the best coverage at competitive rates.

- Review Regularly: Reassess your insurance policies annually to ensure they align with your current needs.

3. Diversify with Low-Risk Investments

While an emergency fund is your first line of defense, low-risk investments can provide additional financial security.

These investments offer stability and modest returns, helping your money grow without exposing it to significant volatility.

Best Low-Risk Investment Options:

- High-Yield Savings Accounts:

- Ideal for short-term goals or additional liquidity. Many accounts offer rates higher than traditional savings accounts.

- Certificates of Deposit (CDs):

- Offer guaranteed returns over a fixed term. Choose short-term CDs to maintain flexibility.

- Example: A 1-year CD with Capital One or Discover Bank.

- Treasury Securities:

- Treasury Bills (T-Bills): Short-term government securities with maturities of less than a year.

- Series I Savings Bonds: Protect against inflation with interest rates tied to the Consumer Price Index.

- Money Market Funds:

- Provide slightly higher returns than savings accounts while maintaining low risk. These are mutual funds investing in short-term, high-quality debt securities.

- Dividend-Paying Stocks:

- Blue-chip companies like Coca-Cola or Johnson & Johnson offer reliable dividends, providing income while preserving capital.

- Warren Buffett’s Insight: Buffett often emphasizes the stability of dividend-paying stocks as part of a diversified portfolio.

Actionable Strategy:

- Allocate 5-10% of your portfolio to low-risk investments as a supplement to your emergency fund.

- Reinvest dividends or interest to maximize compounding.

4. Reduce Financial Vulnerabilities

Beyond savings and insurance, minimizing liabilities and unnecessary risks strengthens your financial safety net.

Key Steps:

- Pay Down High-Interest Debt:

- Prioritize credit card balances and personal loans. High-interest debt erodes financial stability and increases vulnerability during crises.

- Use methods like the 70-20-10 or the Financial Windfall strategies.

- Establish a Budget:

- Track income and expenses to identify areas where you can cut back. Apps like Mint or YNAB (You Need a Budget) can simplify the process.

- Create Multiple Income Streams:

- Diversify your income through side hustles, freelancing, or passive income sources like rental properties or dividend stocks.

5. Regularly Reevaluate Your Safety Net

Your financial situation and needs will evolve over time. Periodically reassess your safety net to ensure it remains adequate and relevant.

Checklist for Reevaluating Your Safety Net:

- Has your income increased? Expand your emergency fund accordingly.

- Have you added new dependents? Adjust life insurance coverage.

- Are there new financial risks? Consider additional insurance or investment options.

- Have your financial goals changed? Shift your low-risk investment strategy to align with your objectives.

Build Resilience for the Future

Creating a financial safety net is essential for navigating uncertain times.

By prioritizing emergency funds, insurance, and low-risk investments, you can protect yourself from financial shocks and gain the confidence to focus on long-term goals.

Take the First Step Toward Financial Security

If you’re looking for ways to boost your financial resilience, consider leveraging a First Lien HELOC to access flexible funds for emergencies or strategic investments.

Try our First Lien HELOC calculator today and start building your financial safety net.